If you just had a baby, or are planning for one, you may be more worried right now about how to pay for diapers and daycare rather than college. But while babies are expensive, those far-off college tuition payments are likely to be one of the biggest expenses you will face as a parent.

Those costs are likely to keep growing, too. Education expenses have outpaced inflation for the last 50 years. Since 1971, tuition, fees, room and board, and other costs for post-secondary education have soared by nearly five times the inflation rate.1

While it’s never been more expensive to put a child through college than it is today, you can get a head start on saving for college. This requires an understanding of how much you’re likely to need and starting a plan early, even if your baby won’t be a college freshman until the 2040s.

How has inflation historically affected tuition?

To understand how college costs have risen to this point, and how they’re likely to keep increasing, let’s look at how the cost to attend a university has changed from the 1980s to the early 2000s.

Annual Tuition and Fees for a Four-Year College Degree2 3

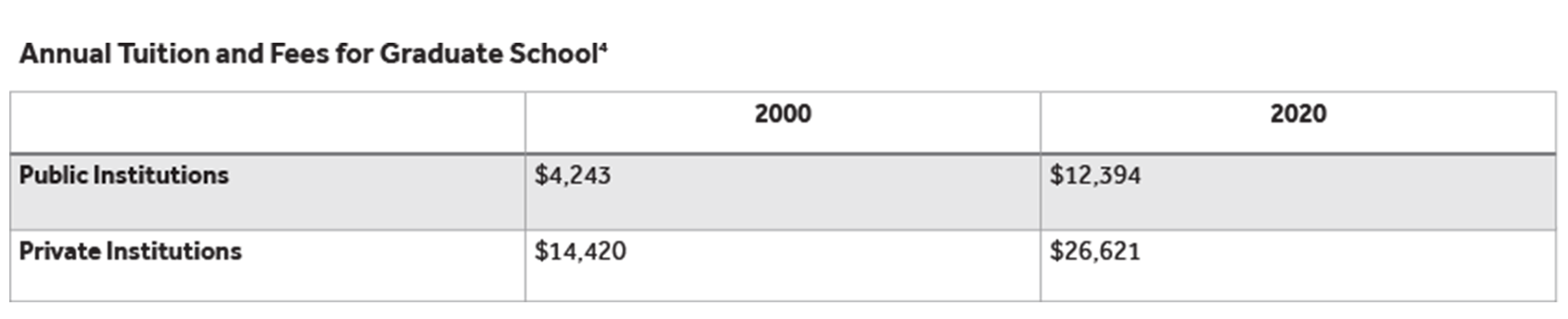

Over the following two decades, costs continued to soar. Between 2009-10 and 2019-20, the total cost of attendance (fees, tuition, room, and board) rose by 39.9% at public four-year schools and 44.2% at private four-year schools.3 Graduate School costs have also risen dramatically in recent years.

Annual Tuition and Fees for Graduate School4

Incomes also rose from 1980 to 2000, but not by as much as college costs. In 1980, the average family had household income of $21,020.5 By 2000, that number had roughly doubled to $42,148.6 While income rose by a factor of two, public school tuition and fees increased nearly tenfold, and private school costs more than quintupled.

Saving for college: What to expect in 2041

College costs have ballooned over the last several decades, and there is no reason to believe that these increases will slow down any time soon - especially as the job market continues to adapt to the education levels of the general public. So how much will college cost in 18 years?

Projected Annual Tuition and Fees for a Four-Year Degree in 20417

Meanwhile, if average income keeps up with a 2.5% annual inflation rate, we can expect the average household, earning $78,813 in 2023, to bring in $122,921 in 2041.8 While this may feel like a substantial increase, it’s no match for the rate that education expenses are growing.

Preparing for the cost: Ways to save

A child’s education can cost hundreds of thousands of dollars, so it’s important to start planning for how those costs will be met as soon as possible. You can plan by considering these important questions.

Who is covering the costs?

Will you, the parent, be responsible for 100% of your child’s college education expenses, or do you expect your children to contribute? Are there others, for instance grandparents, who may be helping you to meet these costs?

Considering this well in advance of when you’ll actually be asked to provide payments can go a long way to helping you budget accordingly. You’ll want to have a clear picture of the figure you’ll need to save for to prepare to borrow for college as the need arises.

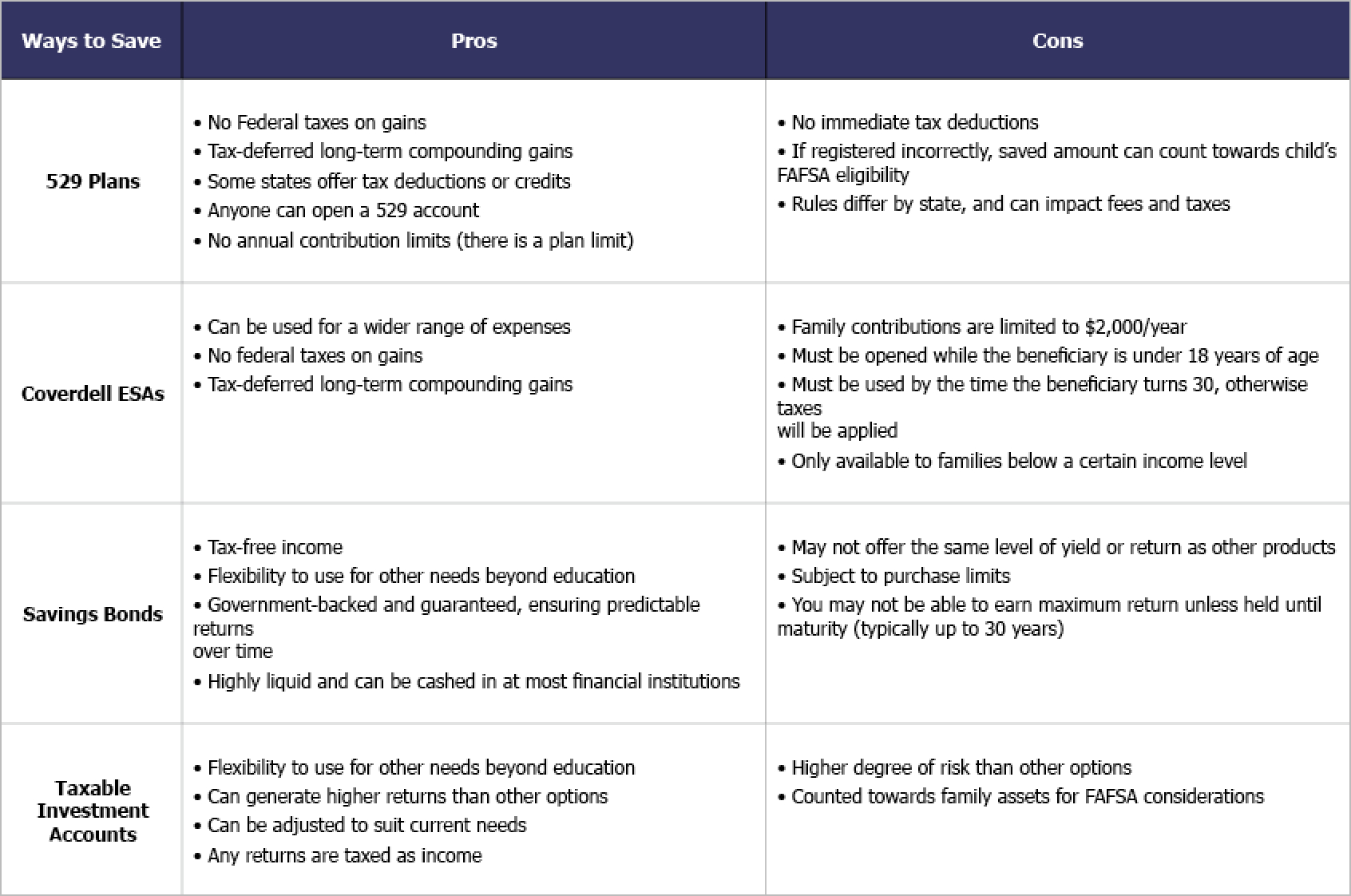

What savings plans should you use?

There are several tax-deferred college savings vehicles that may help you reach your goals. Each plan will have different features that may or may not work for you and your child, including impacts to their Free Application for Federal Student Aid (FAFSA). You should consult with a financial professional to determine the options that might be best for you and your family.

529 plans

529 plans are tax-advantaged savings plans designed to help you save for your or your child’s education and related expenses by investing after-tax income. They can be used to cover education costs for K-12 education, post-secondary education, and apprenticeship programs. The tax-deferred status of these only applies if the funds are used for qualified education expenses.9Coverdell Education Savings Accounts (ESAs)

Coverdell ESAs provide the same tax-deferral benefits as 529 plans, but they are more flexible and can be used for a wider range of educational expenses including tuition, fees, and expenses for private elementary and secondary schools as well as college.

Other strategies for saving for college

Some parents decide against saving for college through dedicated options like 529 plans or Coverdell accounts because they want to be able to use their assets for other expenses if necessary. If you want this kind of flexibility, you may wish to consider these strategies.

Savings bonds

U.S. Treasury bonds generate tax-free income with low risk, making them an attractive alternative for families concerned about market volatility. They also provide a high degree of flexibility. If you don’t use them for college savings, you can redeploy them for other financial needs like retirement.Taxable investment accounts

You can invest for education costs through ordinary investment accounts, putting money into mutual funds, ETFs, or individual securities. You will have to pay current income taxes on any gains in these assets annually if the fund or ETF company reports them as well as for any realized gain when you sell them.

Here is a quick overview of the pros and cons for each way to save for college:

Supplementing college savings with life insurance

Relying on any one savings plan or vehicle for your child’s education can have drawbacks. As shown in the above table, traditional college savings plans can have some limitations, including:

Vulnerability to market downturns and volatility.

Limitations on when, how and for what the funds can be used.

Additional taxes and penalties to withdraw funds for a purpose other than education expenses.

Vulnerability to life events like loss of income or unexpected death of the primary contributor.

A whole life policy can potentially help some families fill some of those gaps when used as a supplement to other college savings plans, because it offers flexibility and security to your longer-term financial strategy.10 It can also act as a financial safety net for you and your family during your working years, in the event of a sudden or unexpected loss of income, such as a job loss, injury, or death.

How can whole life insurance be used to supplement college savings plans?

In addition to a death benefit, a whole life policy builds cash value as long as the policy stays in force.

Families can borrow against the accumulated cash value to pay for a major expense like funding your child’s college education – this is called a policy loan. You can access cash value via loans or withdrawals through surrenders. When accessing cash value via loans, the total outstanding loan balance (which includes accrued loan interest) reduces your policy’s available cash surrender value and life insurance benefit. The amount you borrow will accrue interest daily. When taking a withdrawal through surrenders, you are surrendering any available Paid-Up Additional Insurance for its Cash Surrender Value. This means that your Policy’s Cash Value, available Cash Surrender Value and Death Benefit will be reduced by the amount of the withdrawal. Certain tax advantages are no longer applicable to a life insurance policy if too much money is put into the policy during its first seven years, or during the seven-year period after a “material change” to the policy. If the cumulative premiums paid during the applicable 7-year period at any time exceed the limits imposed under the Internal Revenue Code the policy becomes a “Modified Endowment Contract” or MEC. A MEC is still a life insurance policy, and death benefits continue to be tax free, but any time you take a withdrawal from a MEC (including a policy loan), the withdrawal is treated as taxable income to the extent there is gain in the policy. In addition, if you are under 59 1/2, a penalty tax of 10% could be assessed on those amounts and upon surrender of the policy.

The funds in your cash-value account can be used for any means once withdrawn, which makes them an option for introducing a level of flexibility into your overall financial picture. If you don’t use the funds, they will continue to grow, and if you only use a portion of the funds, the amount remaining in the account will also continue to grow for the duration of the policy, so long as you continue to pay your premiums. Whole life has the added benefit of not being affected by market fluctuations because whole life is not an investment account.

In the unfortunate event that one of the parents passes away before their child goes to college, the guaranteed death benefit11 could also potentially be used in part to contribute to the child’s college education directly. It can also be used to cover other expenses a family may have that take precedence over college savings, meaning the impact on the surviving family member’s ability to contribute to their child’s college savings is diminished.

Whether you use the cash-value account portion of your whole life policy to pay for your child’s education or not, it can add a valuable layer of security and stability to your family’s overall financial picture. Your insurance professional can help you and your family explore life insurance options that may work for you.

The Key is starting early when saving for college

Post-secondary education is expensive and likely to become more so over time. Educational costs have outpaced inflation since the 1970s, and most experts expect this trend to continue. As a result, by the time your newborn is ready to head to college, a four-year education could cost as much $380,000.

Those are daunting numbers, but there’s no need to panic. The sooner you start planning for your child’s education, the more comfortably you will be able to afford it. You can also talk to a financial professional about education savings options that might work for you.

All investments involve risk, including loss of principal. Investments are offered through properly licensed Registered Representatives of NYLIFE Securities LLC (member FINRA/SIPC).

A 529 plan investor should consider the program’s investment objectives, risks, charges, and expenses before investing. The program disclosure statement, available through your Registered Representative, contains more information, and should be read carefully before investing. Before investing, investors should consider whether their home states offer 529 plans that provide state tax and other benefits only available to state taxpayers investing in such plans.

1“The Cost of Going to College Has Risen at Nearly 5x the Rate of Inflation Over the Last 50 Years,” My eLearning World, November 2, 2021.

2 “College Costs in the 1980s,” Education Data Initiative, January 9, 2022.

3“Average Cost of College in the 21st Century,” Education Data Initiative, January 9, 2022.

4“Average and percentiles of graduate tuition and required fees in degree-granting postsecondary institutions, by control of institution: 1989-90 through 2019-20,” National Center for Education Statistics, 2021.

5“Money Income of Households, Families, and Persons in the United States: 1980,” U.S. Census Bureau, July 1982.

6“Money Income in the United States: 2000,” U.S. Census Bureau, September 1, 2001.

7College Cost Projector, Massachusetts Educational Financing Authority, retrieved February 7, 2023

8Inflation Calculator, SmartAsset, retrieved January 31, 2023.

9“Qualified Expenses you can Pay for with a 529 Plan,” U.S. News and World Report, September 9, 2021. Unqualified withdrawals will be subject to ordinary income tax and IRS penalty.

10A whole life policy must be applied for and involves insurance fees and charges, while a 529 plan does not. However, a 529 plan involves investment fees and charges. A whole life policy involves the risk of lapse, in which case the insured would lose the insurance benefit.

11All guarantees are based on the claims-paying ability of the issuer.

This article is provided for general informational purposes only. Neither New York Life Insurance Company, nor its agents, provides tax, legal, or accounting advice. Please consult your own tax, legal, or accounting professional before making any decisions.??

SMRU #5457754.1 exp. 3/13/25